Not many proprietor drivers have adequate cash to pay money for the buy of a vehicle, so it is important to explore the scope of accessible loans and the methodology required to settle a credit application to the common fulfillment of the moneylender and borrower.

There are various sources from which you can acquire support and you should deliberately assess the technique most suited to your own specific budgetary circumstance.

Bank Finance

Despite the fact that banks will proceed as major moneylenders to street transport administrators, search out a chief or individual of power in the financing division who has some knowledge of the industry. Try not to limit your enquiries to simply one bank, as you might get a much better arrangement from a contender also as some new thoughts which might be of incredible help with the running of your business as a truck driver.

For the most part, banks are extremely wary in managing the trucking business also; you might choose to borrow against a home loan, regardless of a business arrangement which affirms the truck buy can maintain a reimbursement system of essential and enthusiasm over the advance period.

Significant Finance Companies

These associations will stay as huge banks to the trucking business, be that as it may, will be a great deal more specific, particularly to any new business with impeccable credit history to acquire fund.

You might find that the Finance Organization will like to work together with existing customers in a substitution truck bargain unless you are generally a safe borrower.

Building Societies

Here likewise, you will most likely find that Building Societies are extremely moderate on their way to deal with the street transport industry and might as it were a loan against land, giving you as the borrower have adequate value.

Credit Unions

For the owner proprietor driver in specific, Credit Unions can give great acquiring plans, with the upside of offering diminished month to month interest. Nonetheless, they will just loan moderately little sums unsecured, in any case, will acknowledge a second home loan as security over times of up to ten a long time.

Truck Finance Brokers

Agents can be of significant help to you in securing an aggressive rate of enthusiasm from an essential loan specialist. You might have family or friends to ensure the advance against security or property in their ownership. According to George Morfoulis, Director of AGM Finance, he advises that “in the event that this is taken up by you as a borrower, ensure the contract is drawn up lawfully and that everyone involved knows about the commitments”.

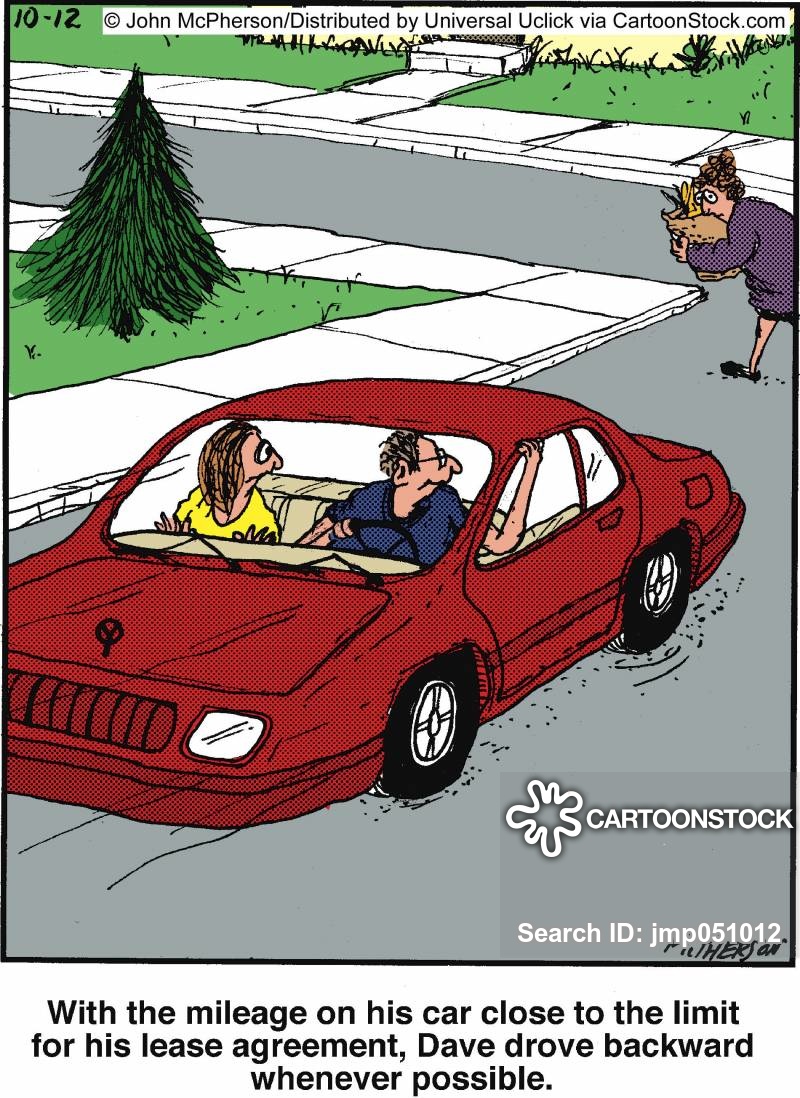

Lease Finance

Renting a vehicle is the most normal type of finance utilized

-

Finance Lease

This arrangement empowers the buy by going into an understanding of the renting organization to make a normal installment over a settled term, for the most part with a leftover esteem toward the end of this period, while having full utilization of the vehicle from the very first moment.

-

Operating Lease

on a basic level a finance lease, when the working lease lapses, the vehicle consequently is come back to the responsibility for the lender, with the tenant waiving any privilege to proceeded with use.

The working lease has a few advantages in that you can arrange the lease responsibility to match precisely with the cartage contract term, with no leftover to pay at all.

Lease account has a distinct favourable position as it is completely charged deductible and effortlessly responsible, be that as it may, similar to all commitments has a few limitations for the resident, specifically:

- Installment default will prompt vehicle repossession and a tremendously decreased deal cost;

- Early payout, by and large, draws in a substantial monetary punishment.

If you have any questions regards to leasing or financing, please seek help from AGM Finance, there is a free consultation for everyone who is looking to work in this truck industry.